- To apply you must be 18+ and a Libyan resident

- Enhanced security.

- Speedy transactions.

- No need to carry cash, checks or credit cards.

- Lower cost per transaction for the merchant, compared to standard debit or charge card fees.

- You will still enjoy the same card benefits you do today - but, now with an additional layer of security via biometric technology.

Mastercard is setting up performance requirements and a testing framework which will work for different climates and environmental conditions. However, there are some technical limitations. If someone has a very greasy finger, the biometrics may not work and instead the card will fall back to a secondary CVM such as PIN or signature, set by the bank.

While stakeholders, economics and opportunities may differ, when it comes to preserving revenue, lowering decline rates of good cardholders and ensuring efficient operations are top priorities for merchants - with the majority indicating that innovative technology is crucial to enhancing security.

Merchants should be aware that with the Mastercard Biometric Card:

- No changes are needed to the software or hardware of a merchant’s POS terminal in order to process Mastercard Biometric Card transactions.

- biometric authentication process is as fast as PIN but saves the cardholder the effort of...

The solution requires no changes for acquirers or merchant hardware or software as it is compatible with any type of EMV-enabled terminal that has satisfactorily completed the Mastercard Terminal Integration Process (TIP).

Below are terminal guidelines to ensure an optimal cardholder experience at the POS for the contact version of the Biometric Card.

Merchants should ensure that their terminals are:

- EMV-enabled

- Customer-facing

- Accessible to cardholders

- Designed so that the card sensor is not blocked from use

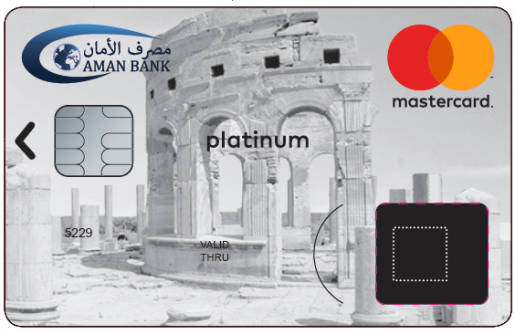

Similar to this

Practical Mastercard

Our customers

لماذا نحن؟

My experience was positive and I'll be happy to refer others to your bank. Thank you.”

As a Merchant, I prefer to use Aman Pay QR because in a short period of time I was able to put my full trust in this service provided by the bank, the direct reason is to provide all that I need as a Merchant from the ease of the sale and purchase process that occurs between me and the customer. After few seconds, the financial value of the purchase is added and a message containing the details of the transaction is sent. The Operation is successfully done.”